Let’s be honest, most of us prefer things to stay as they are. So, when your credit union makes changes, it is natural to feel a little ruffled.

Many insights came from Members who have answered our surveys asking for improved digital tools since our last upgrade in 2017. To those who share thoughtful input, thank you. Your voices matter. We are listening, learning, and adjusting every day to serve you better.

After evaluating all the best-in-class systems out there, we chose a partner committed to security, innovation, a 99%+ uptime, and a future-ready roadmap. This new platform is a leap forward—not just in tech, but in the services now at your fingertips. There is plenty to explore, but I will start with a few of my personal favorites. I hope you find them just as useful and exciting.

Pay bills with ease.

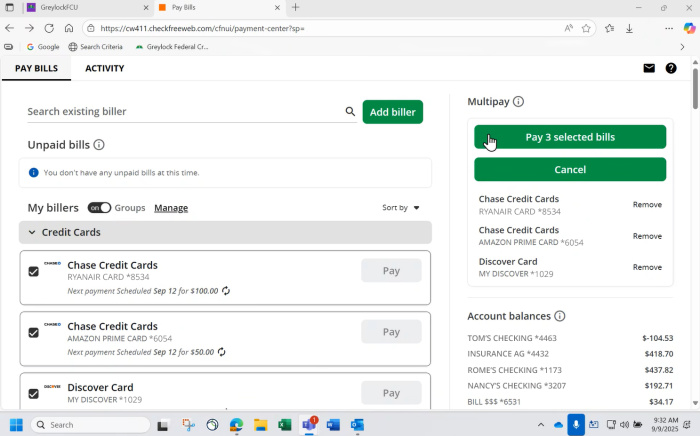

The improved Bill Pay system offers a streamlined experience, and my favorite feature is the Multipay option, which is currently available through the browser. Simply check the box next to each biller you wish to pay, then click “Pay X Selected Bills” in the top right corner— where “X” reflects the number of selected billers.

Select the checking account from the dropdown menu (especially helpful if, like me, you manage multiple accounts). Enter your payment dates and amounts, then click “Pay X Selected Bills” to complete the process. Multipay not only totals the value of selected payments but also displays your account balance when scheduling your payments—giving you full visibility and control.

I like to pay bills weekly to eliminate them faster, but there may be times when I might want to shop instead, just saying. I love that I can also cancel multiple payments at once with Multipay! Since this service shows the next scheduled payments on the billers you have checked, you can delete them by clicking the trash can next to the scheduled payments displayed!

Smart filtering with the Activity Tab.

The Activity tab in the Bill Pay feature offers powerful filtering tools, making it easy to view payments by status—such as scheduled, processing, and processed. You can also track total spending across a host of time periods or set a custom date range for deeper insights.

Card management at your fingertips.

Greylock’s digital banking platform now makes managing your debit and credit cards easier than ever. You can block a card instantly, add travel notes, and more—all without making a phone call or downloading an additional app. You now hold the power to manage your cards securely and conveniently.

One final note, Banker Mom, that’s me, will be hitting the road—hosting working sessions to answer your questions and help you navigate Digital Banking with Greylock. Stay tuned for details! Yours truly, Jennifer Supranowicz “Banker Mom”

Yours truly,

Jennifer Supranowicz "Banker Mom"